Real-time access to banking information also permits fintech apps to enhance the customer experience by providing services like instant funding, automated financial savings, and streamlined payments. That is rapidly changing as a result of open banking, a global shift that’s redefining how monetary knowledge flows. Open banking breaks down financial obstacles by enabling secure, consumer-permissioned data sharing, empowering people to see their complete monetary image in real time, move cash quickly, and access a broader range of monetary products. In conclusion, traditional banking is being disrupted by fashionable banking models like platform banking and BaaS. These fashions provide a extra collaborative and progressive approach, with a concentrate on customer-centricity and technological advancement. The business model of traditional banking is vertical, that means it’s centered on offering providers on to customers, whereas platform banking takes a collaborative approach.

What’s The Difference Between Banking As A Service And Platform As A Service?

However, provided that those techniques nonetheless depend on legacy infrastructure, the benefits behind fast fee systems have been primarily contained to home markets. MUFG Bank aims to consolidate AI model growth platforms scattered throughout the corporate and use the Databricks Knowledge Intelligence Platform as a foundation for growing new AI functions. These monetary banking as a service platform establishments which may be embarking on digital transformation and are leveraging the power of the cloud can begin to unlock an entire new world of prospects.

This shift from traditional to platform banking is pushed by altering customer preferences and the necessity for extra revolutionary and customer-centric fashions. By Way Of APIs, platform banking facilitates safe and managed entry to a bank’s knowledge and functionality, enabling third-party developers to integrate their functions and providers with the financial institution’s platform. So, the banking platform as a service provides banks with a complete suite of digital banking providers that can be accessed via a single platform. Traditional banking involves the provision of primary monetary companies, such as deposit-taking, lending, and different related providers, by banks and monetary institutions on to their clients.

The Difference Between Conventional And Platform Banking

Persistent’s method to Banking as a Platform (BaaP) is centered around providing banks superior software and infrastructure to deliver tailored monetary companies. Wells Fargo, a San-Francisco primarily based banking giant, was one of the pioneers in using banking as a platform. They reduced buyer acquisition prices by a significant margin and enhanced their buyer experience using software program platforms. By leveraging pre-built cores and rich APIs, financial institutions can save priceless development sources and concentrate on delivering best-in-class banking options. Key options of the FinTech Platform embrace P2P cash transfers, multi-currency accounts, and utility bill funds.

Neighborhood monetary establishments should cooperate to compete; however crucially, they must determine a associate that has mutual profit in thoughts. In short, we now have highlighted some factors that we consider clarify the preference for banking-as-a-platform. In highly unsure environments where gamers can not profit from conventional landmarks to make choices, it can be like dancing in the dead of night near a precipice. You dance just like the others do, hoping that all are dancing on the dance floor – what we call Software Сonfiguration Management here the herding effect for banking-as-a-platform.

By integrating third-party fintech services, banks can create new income streams and supply a broader vary of solutions to their customers. For fintech companies, platform banking supplies entry to a larger buyer base and the sources of established financial establishments. The concept of banking platform as a service goes past traditional banking companies and aims to offer prospects with a seamless, built-in expertise that meets their various monetary needs.

This method facilitates higher collaboration and innovation within the business, in the end leading to enhanced customer experiences and operational efficiencies. Embracing banking as a platform underscores the elemental shift from typical banking models to extra agile, customer-centric digital ecosystems. Banking as a platform means transforming banks into ecosystems that provide not solely financial companies but also merchandise and purposes from third-party providers. Banks create digital infrastructures that allow exterior entities like fintech firms to add their services, thereby enhancing customer experiences. This model promotes innovation, collaboration, and a broader range of companies for customers. By Way Of collaborations and partnerships, banks can broaden their service choices past conventional banking merchandise.

I’ve seen banks spend hundreds of thousands on stunning platforms only to struggle with getting prospects. This may seem like a small technical element, but it’s a profound strategic alternative. Every day, new fintech merchandise launch that would have been unthinkable a decade in the past. Second, banking-as-a-platform operations are mostly deployed through partnerships, which are extra versatile than fairness investments and acquisitions, and require a low level of integration.

BaaS (Banking as a Service) and Open Banking are two in style concepts in the banking trade. BaaS enables non-banks to make use of established monetary infrastructure to ship financial institution companies to users. Growth costs and time are decreased, enabling banks to focus on enhancing buyer expertise and integrating software solutions effectively.

In the case of tokenization, institutions must put cash into updating their middle- and back-office workflows to accommodate tokenized assets. Moreover, during the transition to new know-how, establishments might want to run digital-twin operations (e.g., managing each digital and conventional settlement, and different functions) to mitigate operational and regulatory risks. These hurdles mean that institutions need a powerful enterprise case to justify making this transition. Throughout areas, sectors, and establishments, there’s vital experimentation and innovation using DLT applied sciences. A 2024 survey of global capital markets participants—including FinTech firms, banks, and fund managers—revealed that 39 % of the surveyed establishments are adopting DLT primarily to improve internal operations via value financial savings. At the identical time, the survey confirmed that many of those DLT initiatives are fragmented and siloed, involving a restricted number of organizations and thus proscribing their influence.

Despite the use of APIs, open banking has nothing to do with Banking as a Platform and vice versa. Each of these ideas serves a unique objective — although implementing them collectively can in all probability lead to one of the best outcomes. When a financial institution adopts the “Banking as a Platform” model, it deliberately develops a versatile IT infrastructure that enables third-party organizations to use and modify its existing techniques and capabilities. Energy is not found in a singular value-added product (which can only develop linearly), however somewhat within the worth indirectly captured by the (networked) relationship between the service provider and repair client.

With so many enterprise capitalists able to fund concepts, and to mentor these upstarts, entry obstacles have diminished. Banking as a service occupies the minds of consumers, who count on https://www.globalcloudteam.com/ their banks to play a larger function of their daily lives. Adopting an API-fueled, platform strategy brings with it many organizational and technical challenges.

The millennial technology just isn’t the only buyer segment to want extra choice and better service, but they are essentially the most visible driver for change. Around 60% of customers feel that their banks provide them services and products that aren’t relevant to them – an alarming discovery. Software Program Thoughts provides corporations with autonomous development teams who handle software program life cycles from ideation to release and beyond. For over 20 years we’ve been enriching organizations with the talent they should boost scalability, drive dynamic growth and convey disruptive ideas to life. Our top-notch engineering teams combine ownership with leading technologies, together with cloud, AI, data science and embedded software to accelerate digital transformations and boost software delivery.

- Companies should prioritize sturdy information security and compliance with knowledge safety laws, making certain the responsible dealing with of customer knowledge.

- This approach accelerates onboarding and reduces the risk of fraud and human error, two major compliance concerns.

- Moreover, tokenization can present extra liquidity to illiquid belongings (such as real estate or non-public equity), in addition to enable easier and sooner buying and selling on a digital platform.

- The most compelling evidence of their strategy working is their presence in over one hundred nations.

- 80 million accounts managed, $230 billion processed yearly, and 14 million tax refund payments.

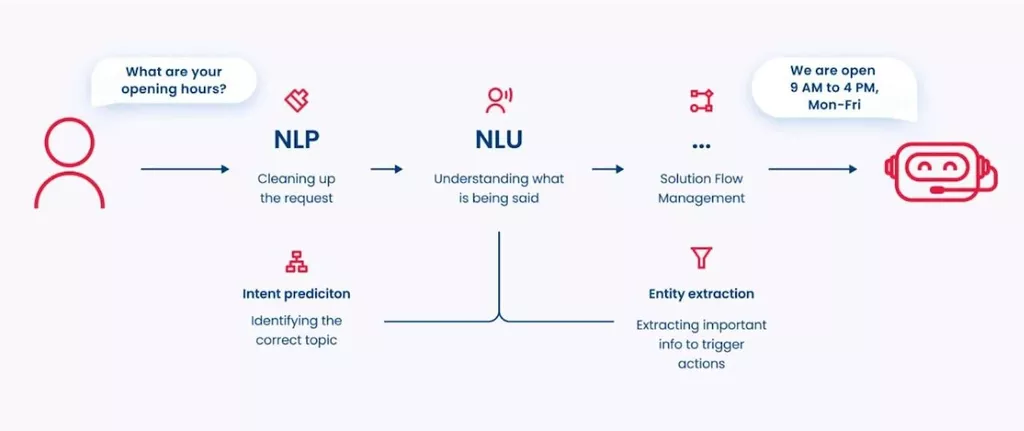

This shift from level options to composable platforms is becoming a strategic benefit for banks trying to streamline onboarding and reply sooner to change throughout the shopper lifecycle. The banks that get it proper are shifting from rigid, legacy workflows to flexible, modular methods that adapt in real-time. Chatbots can help banks scale as much as deal with complicated queries, to complement human interplay, and should adapt to mitigate cultural and language barriers. In customer support offered by humans, the representative units the tone of the conversation based on the temper of the shopper. For example, if an angry buyer vents out words of dissatisfaction, the customer service agent calmly listens with out interrupting and apologizes for the scenario earlier than beginning to resolve the issue.